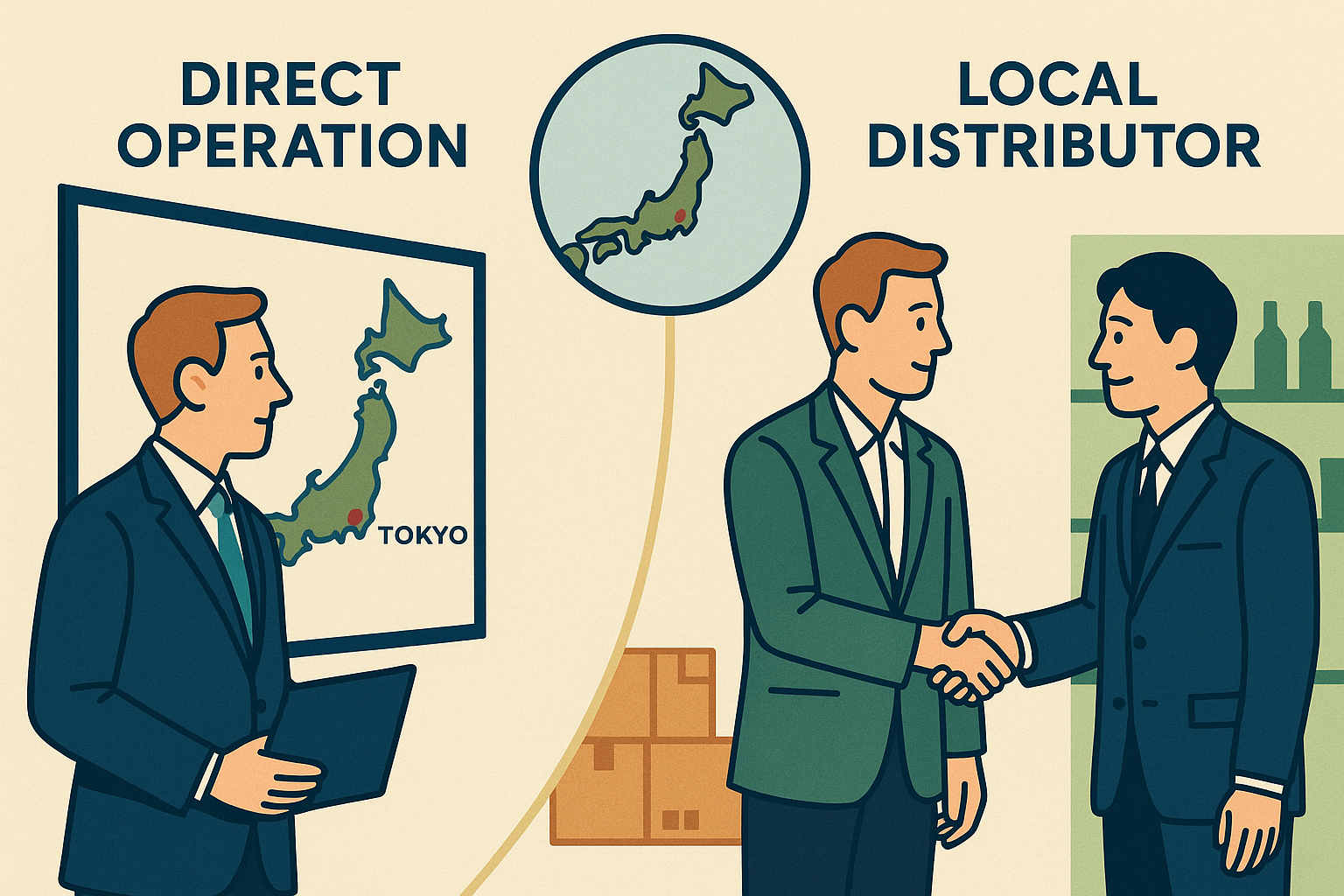

Market Entry into Japan: Strategic Choice Between Direct Operation and Distributor Partnership

Japan is not merely another Asian market—it is a uniquely mature, highly structured economy with distinct business protocols. For global companies evaluating entry strategies, the fundamental question is clear:

Should you establish a direct presence, or partner with a local distributor to accelerate access?

At ShinTai Strategy and Trading, we support international firms in navigating this decision through an integrated, execution-focused approach. From market due diligence to entity setup, distributor evaluation, and regulatory compliance, we serve as your in-country partner for strategic and operational deployment.

Entry Models in Japan: Comparative Considerations

1. Direct Operation (Local Entity Setup)

End-to-End Control: A wholly owned entity allows full oversight of brand, pricing, sales, and marketing—essential for companies prioritizing global consistency and long-term equity creation.

Capital Requirements: Direct entry into Tokyo typically entails investment ranging from USD $55,000–$75,000, covering company registration, office leasing, HR, and legal costs.

Time to Market: Due to visa processing, regulatory setup, and hiring, direct entry generally takes 6 to 10 months to reach operational readiness.

Organizational Learning Curve: Building an in-house team requires deep understanding of Japanese regulations, labor practices, and customer behavior—demanding but foundational for long-term success.

Compliance Accountability: The foreign entity bears full responsibility for tax filings, social insurance, labor contracts, and immigration compliance.

2. Distributor Partnership

Speed and Cost Efficiency: Partnering with a local distributor compresses market entry timelines to 2–3 months and reduces upfront investment to USD $10,000–$20,000.

Local Market Leverage: Distributors bring ready-made networks, cultural fluency, and access to established retail and wholesale channels.

Control Trade-offs: Foreign firms may face diluted brand positioning or inconsistent pricing, particularly when distribution partners have autonomy over go-to-market execution.

Reduced Regulatory Burden: The distributor assumes legal and administrative responsibility, enabling the foreign company to operate without establishing a local entity.

Cultural Stability: One often underestimated strength of the Japanese model is business continuity. Once trust is established, Japanese partners are significantly less likely to switch vendors, ensuring relationship longevity.

Strategic Implication

There is no universal entry model. The optimal path depends on several factors:

Product complexity and required support

Degree of brand control needed

Appetite for capital deployment

Speed-to-market expectations

For many companies, a phased approach proves most effective—initial market penetration via distributor partnerships, followed by a shift to direct operations as traction builds and internal capabilities scale.

How ShinTai Supports Global Brands in Japan

ShinTai acts not merely as an advisor, but as an execution partner on the ground in Japan. We deliver hands-on support across:

Market readiness assessments

Legal entity formation and visa navigation

Distributor evaluation and negotiation

Tax structuring and compliance

Office setup and team sourcing