Reading Japan: A Market Built on Signals

These notes come from shop floors, distributor tables, and quiet conversations

The Real Role of Crowdfunding in Japan and When It Actually Works

Crowdfunding can offer early demand signals, visibility and a controlled environment for testing positioning. What it cannot provide is long-term retail traction, regulatory readiness, supply chain stability or sustainable brand growth. Its correct role is not as an entry mechanism but as a mid-stage validation tool within a larger strategy.

This Insight examines the realities of Japan’s crowdfunding environment, supported by market data, case studies and feedback from international creators.

Japan E-Commerce 2026:A Market Misunderstood, and a Rare Strategic Window

Japan’s e-commerce market in 2026 presents a unique growth opportunity. Despite perceptions of maturity, Japan shows low e-commerce penetration, strong consumer spending, and accelerating digital transformation. As offline retail habits evolve and B2B digitalization advances, brands entering Japan now can capture emerging demand, outperform legacy competitors, and unlock high-value online market potential.

Why Your Emails to Japanese Distributors Get Ignored?

Struggling to enter the Japanese market? Learn why your outreach gets ignored, what trust signals matter, and test your distributor readiness with our free diagnostic.

Choosing Between a Virtual Office and a Physical Office in Tokyo: Strategic Implications for Foreign SMEs Entering Japan

For foreign small and medium-sized enterprises (SMEs) entering the Japanese market, selecting the right type of office space in Tokyo is more than an operational decision — it’s a foundational move that directly influences company registration, visa approval, tax compliance, brand credibility, and customer trust.

This guide provides a comprehensive analysis of the differences between virtual offices and physical office setups in Japan, with practical insight across legal, financial, and operational dimensions. The goal is to help businesses make informed, forward-looking decisions in one of the world’s most structured and conservative markets.

Why Do So Many Western Companies Fail in Japan,Even When Their Product Is Strong?

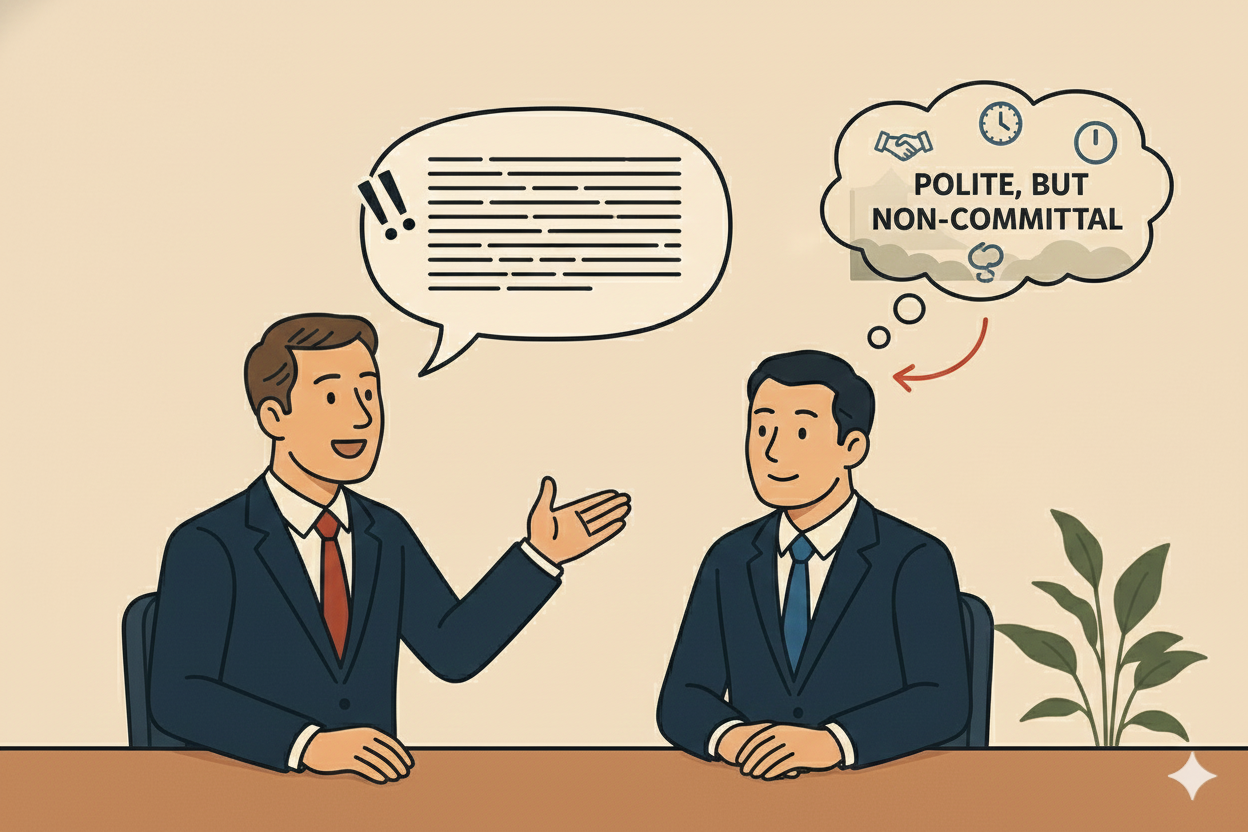

Japan’s market operates on long-term trust, risk control, and a distinctive decision-making structure. Foreign companies that overlook Nemawashi, the behind-the-scenes consensus-building process, or misread who truly holds authority, often struggle to gain traction. Mastering Kiku, the principle of deep listening, and recognizing the influence of quiet senior executives within Japan’s collective-responsibility system are essential for successful entry. This analysis highlights Japan’s business culture, decision logic, market-entry strategy, and the common failure patterns of foreign firms—critical insights for anyone aiming to succeed in Japan.

Japan Import 101: Customs, HS Codes, Compliance and First-Shipment Risks

A complete guide to importing products into Japan: customs requirements, HS Codes, PSE, compliance rules, documentation standards, inspection risks, and how brands can avoid costly delays with proper preparation.

The Definitive Roadmap for Global Companies Establishing in Japan (2026 Edition)

With its stable legal environment, world-class infrastructure, and strong domestic economy, the city offers a launchpad for startups and subsidiaries alike. But how much does it really cost to start a business in Tokyo as a foreigner? This 2026 guide consolidates every legal, financial, and operational consideration you need to know to successfully set up a company in Japan and secure the Business Manager Visa.

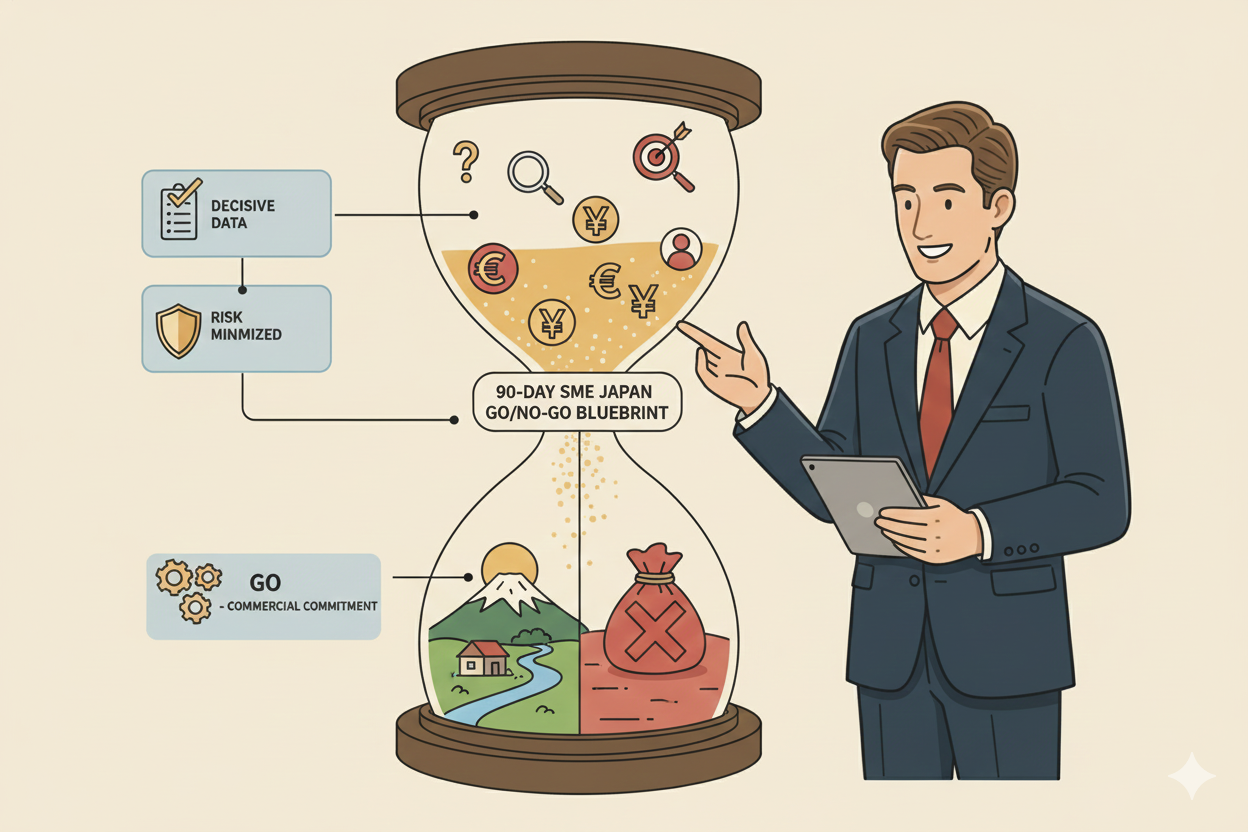

The SME 90-Day Plan: Minimal Resource, Maximum Efficiency Go/No-Go Execution Blueprint (2026)

For Small and Medium-sized Enterprises (SMEs), the goal of the first 90 days in the Japanese market is not sales, but Resource Loss Prevention. We need to use minimal cost investment and time to efficiently acquire the signal on whether long-term commitment to the market is warranted. This action blueprint focuses on critical data acquisition, risk minimization, and the decisive Go/No-Go commercial commitment verification, ensuring every step maximizes your efficiency.

Resource Constraints? 10 High-Efficiency Disciplines for SMEs Entering Japan in 2026

For Small and Medium-sized Enterprises (SMEs) with finite resources, the challenge of the Japanese market is magnified: the cost of trial-and-error is high, and securing brand trust without massive corporate backing is difficult. Entering 2026, success no longer hinges on sheer spending power, but on strategic precision and resource efficiency. This insight provides ten battle-tested principles designed to maximize SME success and rigorously control risk.

Latest Inbound Travel Data: Asia’s Strong Consumer Momentum Toward Japan (2026)

Japan remains one of the most strategic entry points for Western companies expanding across Asia. Its role goes far beyond being a single consumer market. Japan functions as a regional signal hub—what succeeds in Tokyo often shapes demand patterns in Korea, Taiwan, Hong Kong, and Southeast Asia. Below is a concise overview of why Japan deserves priority attention, followed by the latest travel-driven consumer data across Asia, and how Shintai’s JEIP tool helps you assess your market fit with clarity and speed.

SME Focus: High-Value, High-Trust Japan Go-Live Infrastructure Checklist (2026)

Moving into the execution stage, Small and Medium-sized Enterprises (SMEs) must allocate resources intelligently. This checklist bypasses unnecessary frills, focusing instead on Minimum Viability and Maximum Trust in core infrastructure. Treat this as the Quality Assurance (QA) plan for your Japan business, ensuring every investment yields a trust return.

Understanding Japanese Business Culture for Successful Partnerships in Japan

Entering the Japan market has never been a question of price or product alone. It is a question of whether a foreign company truly understands Japanese business culture—its consensus culture, risk-averse business culture, high-context communication norms, and its uncompromising commitment to quality assurance.

What Western Brands Often Overlook: Real-World Friction in Japan

Drawing on a decade of in-market experience, ShinTai has guided global brands through Japan’s unique business rhythm — one built on trust, precision, and subtle communication. These are not barriers, but gateways that demand the right pacing and cultural literacy.

Below are the five most common friction points Western teams face — and how ShinTai’s structured approach resolves each.

Japan B2B Go-To-Market Playbook (2026)

This playbook summarizes how global teams can approach Japan B2B sales, navigate the cultural landscape, and build a scalable engine for Japanese customer acquisition and retention.

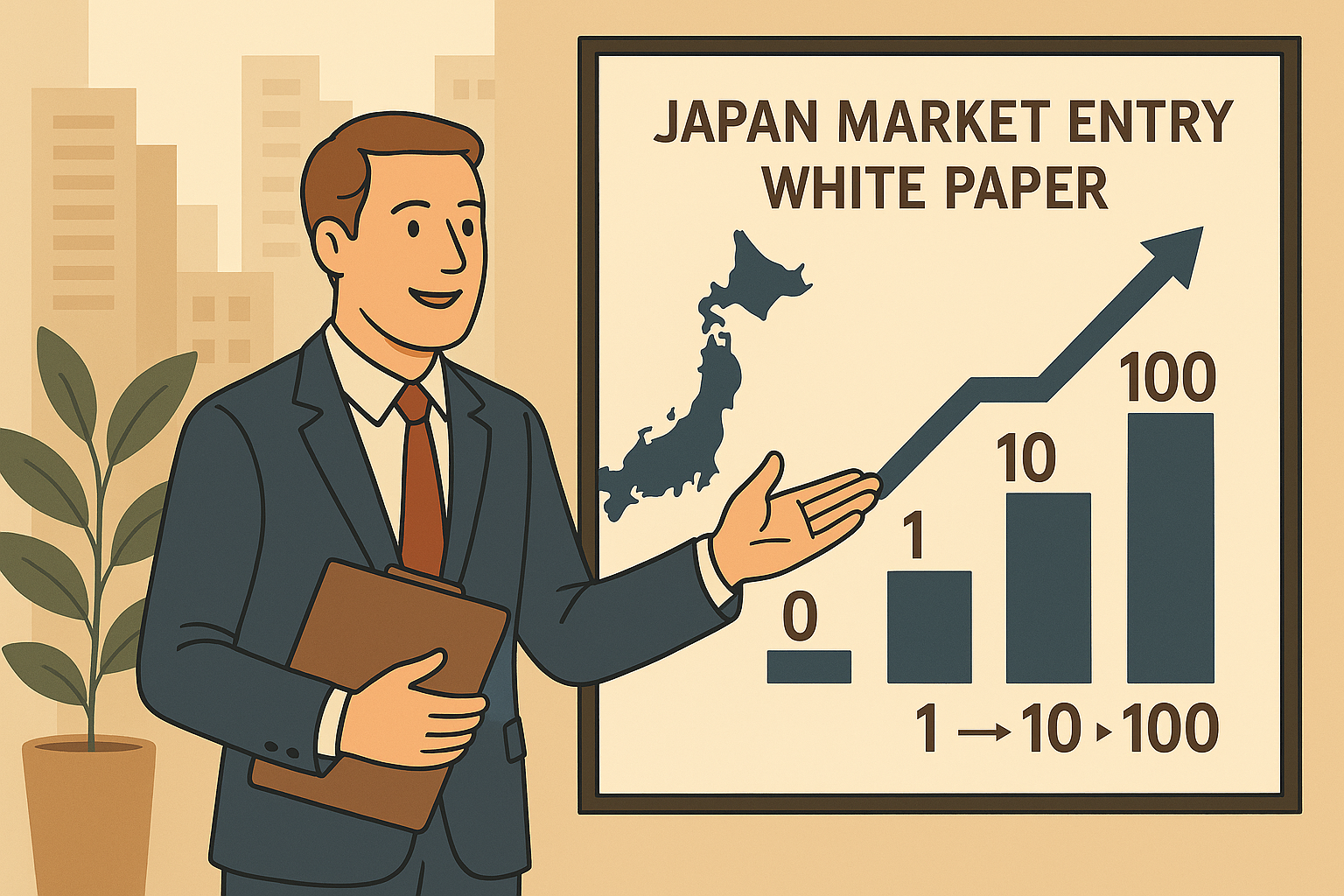

Japan Market Entry White Paper 2026

Japan represents one of the world’s most demanding yet strategically valuable markets. Success here requires far more than product excellence or strong marketing — it demands cultural fluency, strategic discipline, and the gradual accumulation of trust.

Japan Business Manager Visa 2026: A Practical, Data-Backed Playbook for Serious Founders

Japan remains one of Asia’s most desirable yet structurally complex markets for foreign entrepreneurs. While the Business Manager Visa provides a direct legal path to operate a company inside Japan, the real challenge lies in building an application that doesn’t just meet formal requirements—but earns the confidence of Japanese immigration officers.

Before You Launch in Japan: The Hidden Rules Behind Packaging and Compliance

For many overseas founders, Japan feels like the next logical step — stable, premium, and brand-conscious. Yet behind its opportunity lies a market shaped by discipline, detail, and an unspoken code of credibility. The first impression a brand makes in Japan isn’t through advertising or design; it begins with compliance, packaging, and how seriously the brand approaches both..

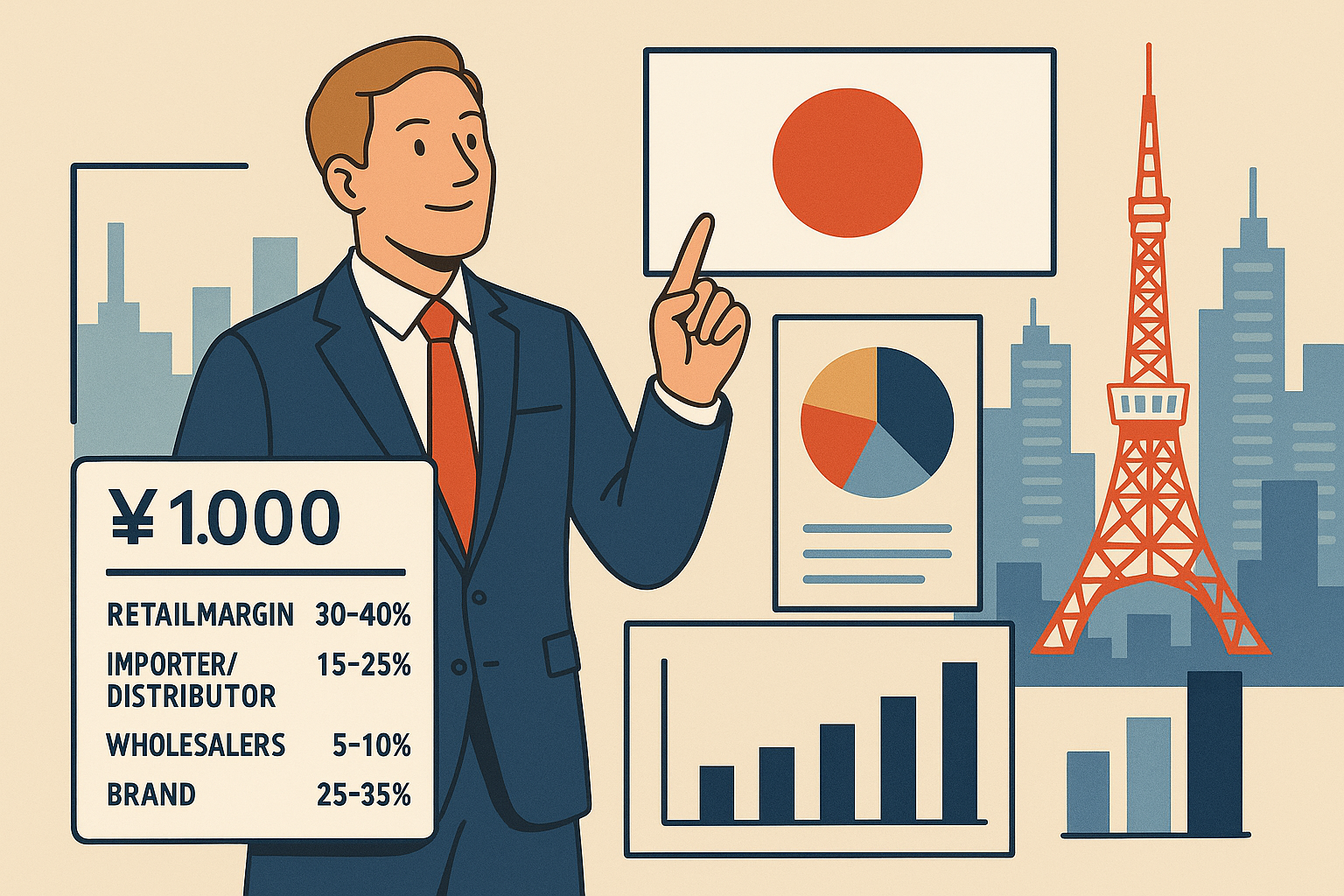

Establishing Distributor Partnerships in Japan: Strategy, Cultural Fit, and Long-Term Success

For many foreign businesses entering Japan, engaging a local distributor is a pragmatic and efficient path to market. This is especially true for sectors such as food and beverage, consumer goods, homeware, cosmetics, and industrial tools—industries where strong local channel access is critical.

Market Entry into Japan: Strategic Choice Between Direct Operation and Distributor Partnership

For many global brands looking to establish a foothold in Asia, Japan represents both a strategic priority and a competitive frontier. Tokyo, as the country’s commercial and industrial capital, is often the first point of entry.